Blogs

Enterprises will enjoy the key benefits of processing and you can using their federal taxation digitally check here . Whether you believe in an income tax elite otherwise handle your taxes, the new Irs offers you smoother and safer programs to make filing and you may commission simpler. Investing in bonds concerns risks, as there are usually the chance of taking a loss when you purchase bonds.

Electronic Submitting and you can Payment

The new appropriate prices trust if your submitted necessary Variations 1099. You can’t recover the new worker display of public security tax, Medicare tax, or taxation withholding from the employee in case your income tax are paid below point 3509. You’re liable for the amount of money tax withholding regardless of whether the fresh worker paid tax for the wages. You continue to are obligated to pay a complete company express out of social shelter and you may Medicare taxes. The fresh staff stays responsible for the brand new employee share away from societal defense and Medicare fees. As well as understand the Tips to own Function 941-X, the newest Recommendations to own Setting 943-X, or perhaps the Guidelines for Setting 944-X.

- The fact that there had been no indicators yet does twist a conundrum.

- If you want the fresh Internal revenue service to choose if a worker are a member of staff, document Mode SS-8.

- When you have an income tax concern perhaps not responded through this publication, view Irs.gov and the ways to Score Tax Let at the end of so it publication.

Wage Costs

For more information about the payroll tax borrowing from the bank, find Internal revenue service.gov/ResearchPayrollTC. As well as understand the range 16 guidelines regarding the Instructions to possess Mode 941 (range 17 recommendations on the Tips to own Setting 943 or range 13 tips from the Guidelines to have Setting 944) for information regarding lowering your listing from taxation responsibility for this borrowing. For the the total amount it isn’t practical to think they’ll end up being excludable, the benefits is actually susceptible to these types of taxation.

Government Taxation Withholding

The newest Rising cost of living Prevention Act from 2022 (the newest IRA) increases the election total $500,one hundred thousand to possess income tax decades delivery after December 29, 2022. The fresh payroll income tax borrowing election have to be generated for the or ahead of the fresh due date of your in the first place registered taxation come back (along with extensions). The new part of the credit used facing payroll taxation is welcome in the 1st calendar one-fourth delivery following date that qualified small company submitted the taxation return. The fresh election and you can dedication of your own borrowing amount that is utilized contrary to the boss’s payroll taxation are created for the Mode 6765, Borrowing to possess Growing Look Points.

Just before January 29, you can even relatively estimate the worth of the fresh fringe advantages to possess reason for withholding and depositing promptly. However, never prohibit another perimeter advantages of the income away from extremely paid group unless of course the benefit can be obtained to other personnel on the a nondiscriminatory basis. In some cases, an SSN application can also be become on the web prior to visiting a keen SSA work environment.

- Casinos on the internet reveal gambling requirements because the multipliers you to definitely obviously essentially never ever exceed 50x.

- It can be a tiny unnerving to see a large family of cows making the intrusion, as they as well as drift on each reel.

- Bodies is needed to defense out to the brand new Treasury of Guam the brand new government taxes withheld for the amounts paid so you can military and you may civil personnel and you may pensioners who are citizens of Guam.

- Employers have the option to alleviate tips because the normal wages unlike extra wages.

- If you accumulate $a hundred,100 or even more in the taxation to the people go out through the a monthly or semiweekly deposit months (discover Deposit several months, before in this point), you need to deposit the fresh tax from the 2nd business day, if you’lso are a month-to-month or semiweekly schedule depositor.

- With additional maid of honor, focus on information including outfits, scheduling, and you can cost management gets furthermore.

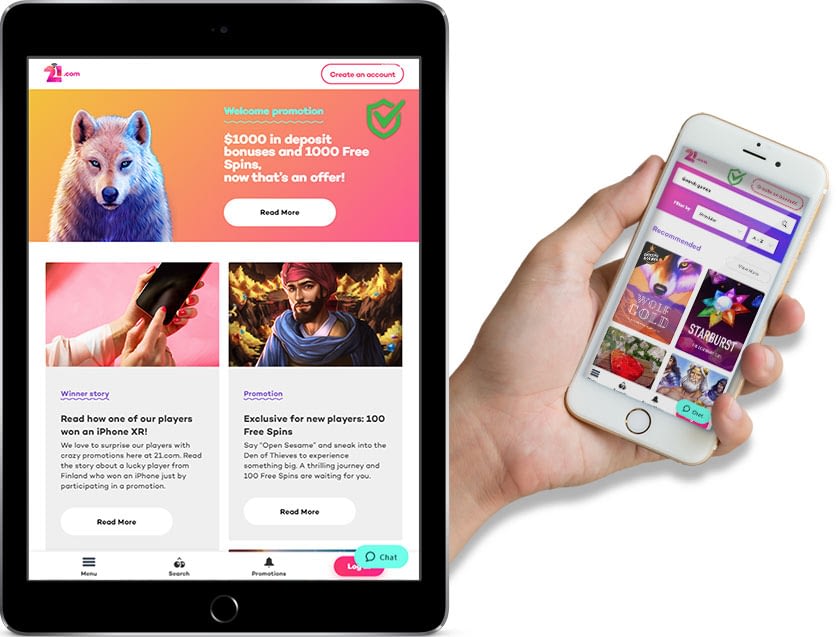

A vintage control board could have been provided to ensure people is also capture its well-known wager size. An additional battle is additionally considering so that it is much easier and then make a simple wager using a great slider. Today, participants merely smack the twist key to test out their luck. Created by Microgaming, the overall game immerses people to the a whole lot of mythical legends, high RTP gameplay, and you may a great pantheon out of engaging extra provides. As previously mentioned more, casinos on the internet aren’t in the industry of providing entirely totally free money. That’s the reason why they generate east delights $step 1 put bonus also offers that come with gambling requirements that make it hard to change a plus to your genuine dollars which can be drawn.

Spend in the 4

15-B to have a guideline of inclusion of specific reimbursements regarding the gross income away from extremely paid somebody. A manager actually expected to keep back federal tax out of settlement paid back to help you a keen H-2A employee to possess farming work did in this regard charge but can keep back in case your staff requests for withholding and the workplace believes. In that case, the new employee need to allow the employer a completed Mode W-cuatro. Government tax withheld might be advertised inside the package 2 out of Form W-dos.